Blog>Inside The Industry: Sustainable Fashion Trends for 2023

Inside The Industry: Sustainable Fashion Trends for 2023

Amber Callender

2023-03-01T14:00:00.000Z

Sustainable progression in the fashion industry has been anything but linear. According to a report from Stand.earth released in November of last year, the industry failed to reduce its carbon footprint in 2022, increasing emissions from the previous year.

Movements towards circularity and digital are among industry trends for the coming year. Let’s see if these trends will have any real impact.

The Second Hand and Rental Market

The Vestiaire Collective & BCG 2022 Report notes that the second-hand fashion and luxury market is now estimated to be worth $100-120B, three times larger than just three years ago. Younger generations bypassing seasonality and adopting circularity are driving market growth, at an expected rate of 20-30% annually. With the stigma around resale shifting, we’ve seen heavyweight retailers like Selfridges and Net-a-Porter integrating these platforms, appealing to the ethical consumer and increasing customer acquisition by offering products at a lower price point.

According to ThredUp’s Resale Report, the resale market is expected to grow sixteen times faster than the broader retail clothing sector by 2026. This comes as no surprise, considering the RealReal’s annual report revealed that consumers motivated by sustainability are turning to luxury resale as an alternative for fast fashion.

Fast fashion brands are now also entering the market, with brands like Pretty Little Thing and Zara launching their own resale platforms in 2022. Though it’s hard to shake the feeling that these efforts are little more than another greenwashing trend within the fast fashion space. Without reducing overall output or, more importantly, improving the quality and longevity of the garments so that they are fit for resale, fast fashion resale platforms are intrinsically ineffectual.

The Issues of the Second Hand Trend

Director of the nonprofit New Standard Institute, Maxine Bédat, has highlighted problems with the resale model, stating that when you lead people to believe a product can have a second life, they “end up consuming the primary good even more, because it is seen as a purchase with no consequences.” This suggests growth within the secondhand market will not cause firsthand consumption to markedly decline.

The RealReal’s Senior Director of merchandising Sasha Skoda has expanded on this sentiment, commenting that “consumers are addicted to newness, regardless of whether it’s from the primary market or secondhand.” She notes that this has been fueled by the rise of social media, the trend for hauls and users buying in bulk to avoid repeating outfits. This alludes to an intrinsic issue surrounding consumer purchasing behaviour.

A Step in the Right Direction?

Whilst the move towards second hand is a step in the right direction, if overconsumption remains at its core, we will need to see a shift in consumer purchasing habits to bring forth real sustainable change.

Alongside resale, the fashion rental market is booming. According to Future Market Insights, the global online clothing rental market is projected to grow at a compound annual growth rate of 11% from 2021 to 2031. While the rental model offers a sustainable alternative to fast fashion consumption, we must question how sustainable the model really is, taking into consideration cleaning between rentals and increased delivery and return emissions. Moreover, the constant influx of new items on these platforms may further contribute to the culture of disposable fashion, in which garments are quickly bought, worn once or twice and then resold.

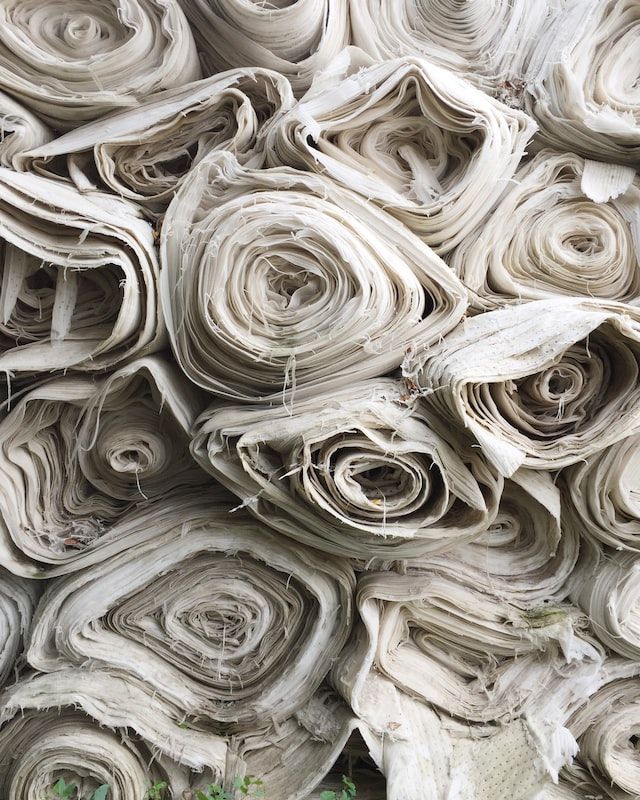

Transforming Textiles

Last year, the European Commission published the EU Strategy for sustainable textiles. The commission set out mandatory design requirements for textiles to ensure they are easier to repair, recycle and to increase longevity in a bid to move towards a circular business model. Increasing transparency policies include the introduction of digital product passports for textile goods, containing mandatory information regarding the sustainability of the product, which should support consumers and stakeholders in their decision-making.

The commission has acknowledged the importance of waste reduction, introducing Extended Producer Responsibility. In order to separate textile waste from market growth, producers must be held accountable for the waste their products create. Textile responsibility requirements are yet to be introduced, but are to include eco-modulation fees and measures to promote a textile waste hierarchy as part of the revision to the Waste Framework Directive in 2023. However, those in the industry argue that the strategy could have gone further to discourage waste given that an estimated 92 million tonnes of textile waste is generated every year.

Could Futuristic Textiles be the Answer?

The World Resources Institute’s research into the roadmap to net zero has identified six interventions that deliver over 60% of the necessary reductions to reach 1.5°C. This involves maximising material efficiency, scaling more sustainable materials and practices, and accelerating the development of innovative materials.

The paper comments on the need for investment in ‘next-generation’ textiles, these are innovative materials such as non-animal or non-plastic alternatives to leather, fur and polyester. Next-gen materials differ from current leather replacements, such as PVC, that rely on harmful chemicals. According to the nonprofit Material Innovation Initiative (MII) investment in the next-gen materials sector dropped from $980 million the previous year to $457 million in 2022. However, the MII’s report notes that 2021 saw an unprecedented spike in capital invested in next-gen companies, whereas 2022 presented a more challenging investment landscape.

Elaine Siu, the MII’s Chief Innovation Officer, has commented that “many industry brands have specific, publicly disclosed targets and pledges to attain measurable improvements in sustainability. Given the significant impact raw materials have on a brand’s environmental footprint, it is expected that these targets will be largely achieved through a transition from incumbent materials to next-gen alternatives.”

Allbirds are among the brands pioneering the use of next-gen materials, partnering with material innovation company Natural Fiber Welding (NFW) to create a plant leather that is 100% plastic free and vegan. Their Plant Pacer trainer features a plant leather upper with a carbon footprint that is 88% lower than traditional leathers.

Let's Get Digital - Virtual Fashion

Over the past five years we’ve seen fashion heavyweights venture into the digital space, with Moschino being one of the first, producing a capsule collection for The Sims. This has birthed brands dedicated to digital fashion, companies like DressX being at the forefront. As one of the world’s first digital fashion retailers, DressX superimpose digital garments over photos and avatars, using AR filters to mold digital garments to the body.

Targeted at content creators, DressX aims to tackle overconsumption by shifting consumption habits from the physical to the digital, operating on the ethos ‘don’t shop less, shop digital.’ Steps into the digital sphere could offer a sustainable solution to the issues raised by RealReal’s Senior Director of merchandising around the desire for newness and avoidance of outfit repetition.

However, whilst this alternative may be viable for content creators, significant change would require a consumer wide shift from the physical to the digital world. Only 23% of respondents to a DressX survey said that they had purchased a virtual fashion piece in lieu of a physical garment. At this point in time digital cannot offer a replacement for the physical, however further developments in the Metaverse and virtual worlds may change these statistics.

The Carbon Footprint of Virtual Fashion

Though virtual fashion exists in the digital, it is not without its carbon impact on the physical world. Following the rise of NFTs, Dolce & Gabbana were among one of many brands to produce an NFT collection, creating nine-pieces to be sold alongside physical garments at the brand’s Alta Moda show in 2021. Data scientist and founder of the Digiconomist, Alex de Vries, estimated the carbon footprint of an NFT garment, such as a white dress for example, to emit around 600 kg of carbon, while a real-world polyester shirt is thought to produce the equivalent of 5.5kg of carbon.

However, this estimate came before Ethereum, the world’s most used blockchain, made the move to proof-of-stake software in September of 2022, reducing the blockchain’s carbon emissions by 99.9%. This is a step in the right direction, considering the virtual fashion market is expected to reach $55 billion by 2030, as forecasted by Morgan Stanley. Though within and outside of the NFT market, internet pollution will continue to impact the environmental cost of digital fashion.

In the more immediate future, brands can make use of digital fashion to combat overproduction by gauging consumer interest. In 2021 DressX partnered with retailer Farfetch to create a carbon-neutral fashion campaign, allowing consumers to pre-order garments showcased digitally on influencers which were produced on demand. More brands are moving towards the pre-order model, which developments in the digital should further encourage.

Closing Thoughts

The rise of rental and resale platforms, alongside legislation from the EU, will force brands to take a more serious approach towards circularity. However, overconsumption still lies at the heart of the industry’s sustainability struggle, requiring a significant shift in consumer behaviour to beget real change.

More

posts

Our use of cookies

onqor.com uses cookies, some are necessary for the operation of the website and some are designed to improve your experience. For more information, click here.

Necessary cookies

Are essential to move around onqor.com and use its core functionality and enhanced features. Without these cookies, services you have asked for cannot be provided.

Functional cookies

Allow onqor.com to remember choices you make to give you better functionality and personal features.

Performance cookies

Help improve the performance of onqor.com by collecting and reporting information about how you use the website.